Mining investments give you access to tangible assets that offer the potential for steady returns. For those seeking both stability and growth, mining can be an attractive option in a sector that remains essential to global markets. In this guide, we’ll walk you through everything you need to know about investing in mining, from bonds and stocks to direct project involvement.

Why Invest in Mining?

Mining stands out from traditional assets like stocks by providing unique advantages. With a constant demand for critical metals and minerals—like gold, copper, and lithium—mining investments can help diversify your portfolio and offer solid long-term growth potential. Here’s why mining might be a smart addition to your investment strategy:

-

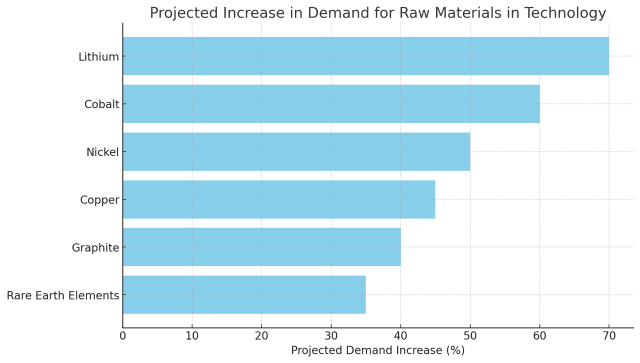

- Steady Demand: With the increasing need for raw materials in technology, renewable energy, and infrastructure, mining investments often experience robust demand.

-

-

- Portfolio Diversification: Including gold in an investment portfolio can enhance diversification, reducing reliance on traditional financial assets. Gold, in particular, is often viewed as a hedge against inflation and market volatility, offering stability in uncertain economic climates

- Attractive Returns: Certain mining investments, like mining bonds, often provide attractive returns due to higher yields and demand for critical minerals.

Mining Bonds: A Unique Investment Opportunity

Mining bonds offer a unique and potentially lucrative investment opportunity for those seeking stable returns in the mining sector. Here’s how mining bonds work and why they might appeal to your investment goals:

-

- Higher Yields: Mining bonds, particularly those focused on precious metals like gold, often deliver higher yields compared to traditional corporate bonds. This makes them an attractive choice for investors seeking reliable, long-term income. The intrinsic value of gold and its market demand further contribute to these high returns, appealing to income-focused investors.

-

- Tangible Asset Backing: Mining bonds provide security by being backed by tangible assets like gold reserves, which hold enduring value. This asset backing offers investors a stable foundation, as gold is a universally recognized store of wealth, making it a compelling choice for those seeking a secure investment.

-

- Growth Potential: With the global shift toward renewable energy, metals and minerals like lithium, copper, and cobalt are essential, driving demand for mining activities.

“Investing in mining bonds can offer a consistent return and a chance to be part of a critical industry in today’s economy. By strategically diversifying, investors may find that mining bonds help balance risk while benefiting from industry growth.” – Rachel Buscall, CEO of New Capital Link

Types of Mining Investments

When looking to invest in mining, there are several avenues to consider, each with its own benefits and risks.

1. Mining Stocks

Mining stocks allow you to invest directly in companies that mine precious metals, minerals, and other essential resources. This type of investment often benefits from rising commodity prices but is subject to market fluctuations.

-

- Pros: High liquidity, easy access to trading, potential for high returns.

-

- Cons: Volatile prices, dependency on commodity market fluctuations.

2. Mining Bonds

Mining bonds are an appealing option for investors looking for a lower-risk, income-generating investment in the mining sector. By investing in mining bonds, you can support resource development projects while benefiting from the sustained demand for metals and minerals.

-

- Pros: Consistent returns, asset-backed security, lower volatility.

-

- Cons: Lower liquidity compared to stocks, interest rate sensitivity.

3. Direct Investment in Mining Projects

Direct investments offer a way to participate in specific mining projects, often through private placements or investment groups like Intergroup Mining. These projects allow investors to support and benefit from the extraction and sale of valuable resources like gold, copper, and rare earth elements.

-

- Pros: High potential returns, direct asset ownership, tangible involvement in project success.

-

- Cons: High initial investment, limited liquidity, operational risks.

Steps to Start Investing in Mining

To start investing in mining, follow these steps to make informed decisions:

-

-

Assess Your Risk Tolerance

Mining investments vary in risk, so it’s important to know your comfort level with potential market volatility.

-

-

-

Select Your Investment Type

Choose from mining bonds, stocks, or direct project investments, each offering unique benefits.

-

-

-

Consider Professional Advice

Due to the complexities of mining investments, consulting a financial advisor can help guide you to the best investment opportunities.

-

Intergroup Mining: A Standout Opportunity in the Mining Sector

One notable option for those looking to invest in mining is Intergroup Mining. Intergroup Mining is a company dedicated to exploring and developing mining projects, with a primary focus on gold and kaolin. Intergroup Mining Limited offers unregulated convertible loan notes with a 12% annual return over a three-year term

“Intergroup Mining provides a chance to contribute to the essential transition to renewable energy while securing valuable mineral assets.” -Rachel Buscall, CEO of New Capital Link

Final Thoughts: Is Mining a Good Investment?

Mining investments offer a blend of stability, income potential, and growth. Whether you choose mining bonds, stocks, or direct project investment, mining can be a valuable addition to your portfolio if approached strategically.

For investors seeking a stable return, mining bonds like the ones offered by Intergroup Mining present exciting opportunities in an essential global industry.

Get Started Today

If you’re interested in learning more about how to invest in mining, contact our team for personalised advice and to explore your options in the mining industry.

Related articles: