Investing £15,000 is a significant step towards building your financial future. While it may not be as substantial as £1 million, it’s still a considerable sum that, if invested wisely, can yield impressive returns over time. This article will explore various ways to invest £15,000 and provide estimated indicative returns.

Setting Clear Investment Objectives for Your £15,000

Before diving into investment options, it’s crucial to define clear objectives for your £15,000. Consider factors such as:

Financial goals (e.g., saving for a house deposit, building retirement funds)

This refers to the specific purposes for which you’re investing your money. Your financial goals should be clear, measurable, and time-bound. Examples include:

- Saving for a house deposit: You might aim to accumulate £30,000 over 5 years for a down payment on a home.

- Building retirement funds: You could set a goal to have £500,000 in your pension pot by age 65.

- Funding your children’s education: You might want to save £50,000 over 15 years for university fees.

- Starting a business: You may aim to save £100,000 over 10 years to launch your own company.

Your financial goals will significantly influence your investment strategy, as different goals may require different approaches.

Risk tolerance

Risk tolerance is your ability and willingness to endure fluctuations in the value of your investments. It’s often influenced by factors such as:

- Your age: Younger investors typically can afford to take on more risk as they have more time to recover from potential losses.

- Your financial situation: Those with stable incomes and substantial savings might be more comfortable with risk.

- Your personality: Some people are naturally more risk-averse than others.

Understanding your risk tolerance helps you choose investments that won’t cause you undue stress or lead you to make hasty decisions during market volatility.

Investment timeline

This refers to how long you plan to keep your money invested before you need to use it. Your investment timeline can be:

- Short-term: Less than 3 years

- Medium-term: 3-10 years

- Long-term: More than 10 years

Generally, the longer your investment timeline, the more risk you can afford to take, as you have more time to recover from potential market downturns.

Need for accessibility to funds

This factor considers how easily and quickly you might need to access your invested money. Some investments, like stocks or bonds, can be sold relatively quickly, while others, like real estate or certain types of bonds, may be less liquid.

Consider:

- Do you need an emergency fund that’s easily accessible?

- Are you comfortable locking away money for a set period?

- Do you foresee any major expenses in the near future?

Understanding your need for liquidity helps ensure you don’t invest money you might need at short notice in less accessible investment vehicles.

What Are Your Investment Options?

When investing £15,000, there are several factors to consider:

Risk Appetite

Determine how much risk you’re comfortable with. Generally, higher potential returns come with increased risk.

Length of Investment

Consider how long you’re willing to keep your money invested. Longer-term investments often have the potential for higher returns.

Capital Accessibility

Think about how often and quickly you might need to access your funds. Some investments may have penalties for early withdrawal.

Popular Investment Options for £15,000

Stocks Return Potential

8/10 Risk Potential: 6/10

Investing in stocks can offer significant growth potential. Consider using a low-cost index fund or ETF to gain broad market exposure.

Bonds Return Potential

5/10 Risk Potential: 3/10

Bonds can provide stable income and are generally less risky than stocks. They’re a good option for more conservative investors.

ISAs Return Potential

4/10 Risk Potential: 1/10

ISAs offer tax-free savings and investment options. Consider a stocks and shares ISA for potentially higher returns.

Robo-Advisors Return Potential

6/10 Risk Potential: 4/10

Robo-advisors offer automated, low-cost investment management, ideal for hands-off investors.

Peer-to-Peer Lending Return Potential

7/10 Risk Potential: 5/10

P2P lending can offer higher returns than traditional savings accounts, but comes with increased risk.

How to Choose the Right Investment Strategy for £15,000

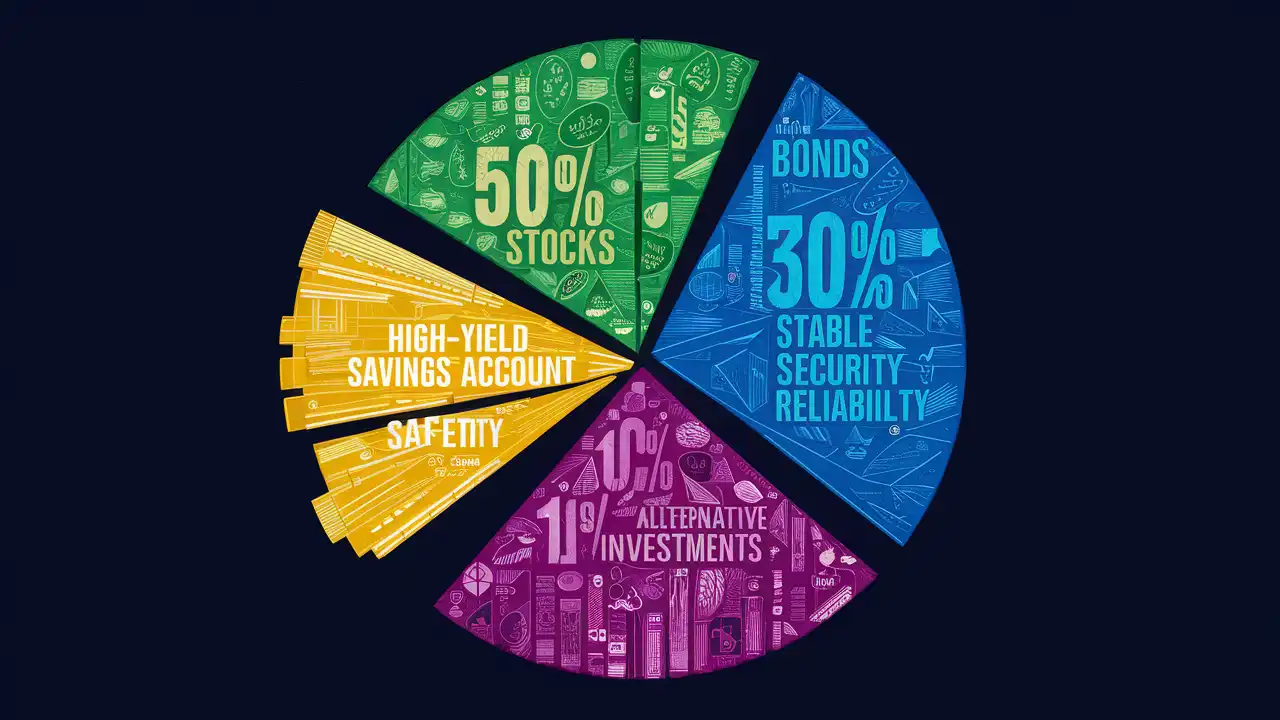

Diversification Spread your £15,000 across different asset classes to minimise risk. A balanced portfolio might include:

- 50% in stocks (e.g., low-cost index funds)

- 30% in bonds

- 10% in a high-yield savings account

- 10% in alternative investments (e.g., P2P lending)

Consider Professional Advice While £15,000 may not seem like enough to warrant professional advice, a financial advisor can help you create a tailored strategy that aligns with your goals and risk tolerance.

Regular Review and Rebalancing Set a schedule to review your investments, perhaps quarterly or bi-annually. Rebalance your portfolio as needed to maintain your desired asset allocation.

Summary

Investing £15,000 is an excellent opportunity to grow your wealth over time. By carefully considering your options, diversifying your investments, and regularly reviewing your strategy, you can make the most of this sum. Remember, all investments carry some level of risk, so it’s essential to do thorough research or consult with a financial professional before making any investment decisions.

Alternative Investments London

Investing £15,000 is an important step in your financial journey. While it may seem daunting at first, with careful planning and a clear understanding of your goals, you can make informed decisions that align with your financial aspirations.

Remember, the key to successful investing lies in diversification, patience, and ongoing education. Whether you choose to invest in stocks, bonds, ISAs, or explore options like robo-advisors or peer-to-peer lending, each path offers unique opportunities and challenges.

As you embark on this investment journey, consider seeking advice from financial professionals who can provide personalised guidance based on your specific circumstances. They can help you navigate the complexities of the investment world and potentially avoid common pitfalls.

Ultimately, the best investment strategy is one that you’re comfortable with and that helps you progress towards your financial goals. Start small, stay informed, and don’t be afraid to adjust your strategy as your circumstances change.

Remember, investing is a marathon, not a sprint. With patience, discipline, and a well-thought-out plan, your £15,000 investment today could grow into a significant nest egg for your future.

See also: