What Is A Loan Note?

In its most simplistic form, a loan note is a form of an I-Owe You (IOU) document from one provider/party/business to another. It is the basis of a contract whereby you agree to loan (invest) money with the third party, and in return, you will receive either a fixed or variable interest rate for the length of the loan. Loan notes will invariably have an end date, which specifies when the money and the interest will be paid back in full.

Although a loan note is similar to an IOU, it still denotes various legal entities. A standard legal loan note will lay out the terms, procedures, and legal accountability of both parties (borrower/lender). It will also set out clear terms for a list of contractual penalties, this will invariably include the right to sue or seek arbitration if either the borrower or lender fails to meet the specified terms. The arbitration clause can also be actioned if the borrower defaults on payments.

Table of Contents

Key Features of Loan Notes

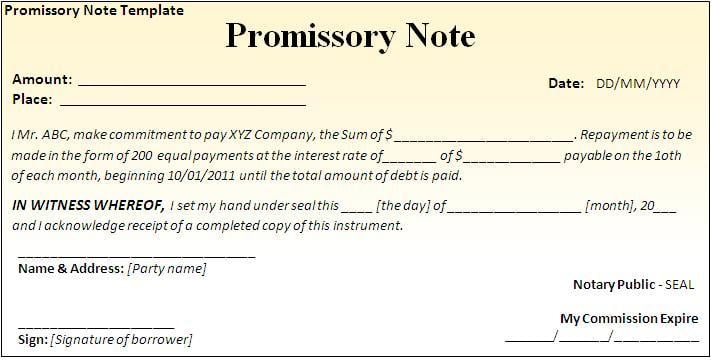

- A loan note is a type of promissory agreement that outlines the legal obligations of the lender and the borrower.

- A loan note is a legally binding agreement that includes all the terms of the loan, such as the payment schedule, due date, principal amount, interest rate, and any prepayment penalties.

- Lenders typically require borrowers to agree to loan notes for big-ticket purchases, such as a home or car.

- Loan notes can have tax benefits to the borrower and can also be a convenient source of seed money for new entrepreneurs and startups.

- In many cases, a loan note is preferable to an informal IOU because a loan note holds more legal significance and is easier to uphold in court should there be a disagreement between the parties.

- Loan notes are an alternative to regular loan agreements and may be preferred in certain situations, such as raising money from multiple lenders, having flexibility in the borrowing amount, facilitating the transferability of the debt, or getting listed to avoid withholding tax.

- Loan notes can be secured (backed by collateral) or unsecured. Secured notes provide more protection for lenders.

- Provisions around transferring loan notes, amending terms, registering with authorities, cancelling notes upon repayment, etc. are typically governed by the specific loan note instrument.

- There can be different types of loan notes convertible (converting to equity), traded (using stocks as collateral), etc.

- Majority noteholders may have powers like enforcing default, but oppressing minority noteholders could be challenged legally.

- Tax treatment, use of gross-up clauses for withholding taxes, and specified redemption dates are other consideration

How A Long Note Works?

A loan note, a form of promissory agreement, includes all of the associated loan terms. It is considered a legally binding agreement with both parties committed to the terms as written. A loan note can be drawn up by either borrower or lender, though it is more traditionally completed by the lender. The note is considered valid until the amount listed on the document is paid in full by the borrower.

Information contained in a Loan Note

The loan note contains all pertinent details regarding the legal agreement reached by the involved parties. This includes the names and contact information for both parties, as well as the principal balance and any interest rate being applied over the loan’s term. Additional information regarding the payment schedule, including the due date, will be included.

Penalty information may also be present. This can include repercussions for late payments or information about prepayment penalties. While prepayment clauses protect the lender against losing interest income over the loan’s course, it means the borrower will pay a penalty for paying down or paying off the loan during a specified time, usually within the first few years of the loan’s start date.

Example of a Loan Note

Loan notes are used mostly for instalment debts in which the borrower is making a purchase of a particular good or service and paying the amount back over time. A common consumer need for a loan note is a home purchase, which includes a loan note along with the mortgage or deed of trust. Loan notes are also used for vehicle financing and most other forms of instalment loans. According to recent statistics, over 80% of new car purchases in the UK involve some form of loan note or finance agreement.

Benefits of Loan Notes

A loan note can help an individual avoid an undue tax hit due to a lump-sum payment from a settlement or cash-out package from a company. In these cases, the individual is given a choice between cash or a loan note. When loan notes are used between businesses, the purchaser can act as a borrower and make payments over time, often at a minimal interest rate.

Loan notes can be fairly simple to draw up and convenient for both parties. As Rachel Buscall, CEO of New Capital Links states: “Convertible loan notes are a vital part of our investment offering. They provide a flexible way for investors to back exciting growth companies while protecting their downside risk.”

They can represent the first form of funding for young businesses. Startups and new entrepreneurs often use them to obtain seed capital from friends and family to establish a business.

Special Considerations for Loan Notes

Legally, a loan note holds more significance than an informal IOU, even when the informal IOU is notarised. Generally, a loan note will be upheld unless either party can prove the agreement was entered into while under duress, which may make the conditions within the document void, rendering them unenforceable.

Are there different types of loan notes?

Yes, there are several key types:

Secured – Any secured loan note is one that’s insured using the borrower’s assets as collateral, also known as a personal guarantee. This provides legal assurances to the lender that their investments are secure in case of insolvency.

Traded loan notes – Instead of physical assets, some loan notes use company stocks as collateral. Should debts not be paid, these stocks will be sold to cover the costs.

Unsecured – Unsecured loan notes have no collateral backing them up, making them very high risk for lenders as there is no obligation to repay if the company goes under.

Convertible loan notes – Used when a business needs rapid access to funds, a convertible loan note can convert to equity either after an agreed period or if a specific event occurs, such as a change in control of the company.

Can loan notes be transferred?

If the terms and conditions of the loan note allow for transfer, then yes. These terms need to be agreed well in advance to ensure both parties’ interests are protected. The loan note holder will need to relinquish the certificate and all rights to the new holder for a successful transfer.

Many private equity transactions involving stocks are difficult to transfer and will often include restrictions, with certain aspects being transferable and others not.

Are loan notes for business use only?

No, loan notes can be used by individuals, companies, partnerships, and organisations – there’s no real limit to who can issue one. However, certain types like convertible loan notes are less suitable for personal lending situations where there is no company equity to convert into.

How to protect your assets when borrowing money

Most loan notes require a personal guarantee to secure the investment, which means putting a lot of personal capital on the line. Personal guarantees hold directors/founders personally responsible for repaying any debts. So if company assets cannot cover what’s owed, you could find yourself personally liable for paying back large amounts.

The answer is personal guarantee insurance. By insuring some or all of your personal guarantee, you’re safe in the knowledge that much of your investment is protected if your business becomes insolvent.

Can I buy insurance on my loan note investments?

Yes, there are insurance products available that can cover up to 80% of the value of a personal guarantee on a loan note. This protects your assets if you are unable to repay the loan.

What kind of industries offer convertible loan notes?

Convertible loan notes are commonly used by startups and growth companies, particularly in sectors like technology, biotech, and other innovative industries where companies need funding for R&D or rapid expansion before going public. Major venture capital firms frequently invest via convertible loan notes.

A new popular addition to the loan note family is property developers. Ordinarily, the developer will have gained planning permission and have verified capital, the only thing they will require is capital. The loan note will often be for the duration of the project, and will likely be repaid once the development is sold or complete

How do I invest in convertible loan notes?

For individual investors, the main ways are:

-

- Directly with startups/growth companies raising funds this way

-

- Through crowdfunding platforms that facilitate convertible note investments

-

- Via investment funds that include convertible loan notes in their portfolios

Thorough due diligence is required as convertible loan notes carry more risk than traditional loans.

How a Loan Note Works

A loan note, a form of promissory agreement, includes all of the associated loan terms. It is considered a legally binding agreement with both parties committed to the terms as written. A loan note can be drawn up by either the borrower or lender, though it is more traditionally completed by the lender. The note is considered valid until the amount listed on the document is paid in full by the borrower.

Information contained in a Loan Note

The loan note contains all pertinent details regarding the legal agreement reached by the involved parties. This includes the names and contact information for both parties, as well as the principal balance and any interest rate being applied over the loan’s term. Additional information regarding the payment schedule, including the due date, will be included.

Penalty information may also be present. This can include repercussions for late payments or information about prepayment penalties. While prepayment clauses protect the lender against losing interest income over the loan’s course, it means the borrower will pay a penalty for paying down or paying off the loan during a specified time, usually within the first few years of the loan’s start date.

Example of a Loan Note

Loan notes are used mostly for instalment debts in which the borrower is making a purchase of a particular good or service and paying the amount back over time. A common consumer need for a loan note is a home purchase, which includes a loan note along with the mortgage or deed of trust. Loan notes are also used for vehicle financing and most other forms of instalment loans. According to recent statistics, over 80% of new car purchases in the UK involve some form of loan note or finance agreement.

Benefits of Loan Notes

A loan note can help an individual avoid an undue tax hit due to a lump-sum payment from a settlement or cash-out package from a company. In these cases, the individual is given a choice between cash or a loan note. When loan notes are used between businesses, the purchaser can act as a borrower and make payments over time, often at a minimal interest rate.

Loan notes can be fairly simple to draw up and convenient for both parties. As Rachel Buscall, CEO of New Capital Links states: “Convertible loan notes are a vital part of our investment offering. They provide a flexible way for investors to back exciting growth companies while protecting their downside risk.”

They can represent the first form of funding for young businesses. Startups and new entrepreneurs often use them to obtain seed capital from friends and family to establish a business.

Special Considerations for Loan Notes

Legally, a loan note holds more significance than an informal IOU, even when the informal IOU is notarised. Generally, a loan note will be upheld unless either party can prove the agreement was entered into while under duress, which may make the conditions within the document void, rendering them unenforceable.

Are there different types of loan notes?

Yes, there are several key types:

Secured – Any secured loan note is one that’s insured using the borrower’s assets as collateral, also known as a personal guarantee. This provides legal assurances to the lender that their investments are secure in case of insolvency.

Traded loan notes – Instead of physical assets, some loan notes use company stocks as collateral. Should debts not be paid, these stocks will be sold to cover the costs.

Unsecured – Unsecured loan notes have no collateral backing them up, making them very high risk for lenders as there is no obligation to repay if the company goes under.

Convertible loan notes – Used when a business needs rapid access to funds, a convertible loan note can convert to equity either after an agreed period or if a specific event occurs, such as a change in control of the company.

Can loan notes be transferred?

If the terms and conditions of the loan note allow for transfer, then yes. These terms need to be agreed well in advance to ensure both parties’ interests are protected. The loan note holder will need to relinquish the certificate and all rights to the new holder for a successful transfer.

Many private equity transactions involving stocks are difficult to transfer and will often include restrictions, with certain aspects being transferable and others not.

Are loan notes for business use only?

No, loan notes can be used by individuals, companies, partnerships, or organisations – there’s no real limit to who can issue one. However, certain types like convertible loan notes are less suitable for personal lending situations where there is no company equity to convert into.

How to protect your assets when borrowing money

Most loan notes require a personal guarantee to secure the investment, which means putting a lot of personal capital on the line. Personal guarantees hold directors/founders personally responsible for repaying any debts. So if company assets cannot cover what’s owed, you could find yourself personally liable for paying back large amounts.

The answer is personal guarantee insurance. By insuring some or all of your personal guarantee, you’re safe in the knowledge that much of your investment is protected if your business becomes insolvent.

Can I buy insurance on my loan note investments?

Yes, there are insurance products available that can cover up to 80% of the value of a personal guarantee on a loan note. This protects your assets if you are unable to repay the loan.

What kind of industries offer convertible loan notes?

Convertible loan notes are commonly used by startups and growth companies, particularly in sectors like technology, biotech, and other innovative industries where companies need funding for R&D or rapid expansion before going public. Major venture capital firms frequently invest via convertible loan notes.

How do I invest in convertible loan notes?

For individual investors, the main ways are:

-

- Directly with startups/growth companies raising funds this way

-

- Through crowdfunding platforms that facilitate convertible note investments

-

- Via investment funds that include convertible loan notes in their portfolios

Thorough due diligence is required as convertible loan notes carry more risk than traditional loans.

New Capital Taken On What is a

Loan Note Specialists

New Capital Links is an investment firm specialising in helping growth companies in the tech and life sciences sectors access funding through convertible loan notes and other investment structures. Check out Our guide to convertible loan note investments or contact them to discuss investment opportunities.

Most Recent Articles