When it comes to property bond rates, the investment term and frequency of interest payments play a crucial role. Typically, shorter-term property bonds with more frequent interest payments offer lower overall target property bond rates, usually around 5% per annum. On the other hand, longer-term property bonds ranging from 4 to 5 years may provide higher target property bond rates, often in the range of 7% per annum.

What’s a Property Bond?

A property bond is a debt instrument issued by a company or real estate investment trust (REIT) that is secured by a portfolio of income-producing properties, such as commercial real estate, residential properties, or a combination of both. These bonds are typically used to finance the acquisition, development, or renovation of real estate projects.

How Do Property Bonds Work?

Property bonds function similarly to traditional corporate bonds, with investors lending money to the issuer in exchange for periodic interest payments and the eventual return of their principal investment at maturity. However, the key distinction lies in the underlying collateral – property bonds are backed by real estate assets, providing investors with an additional layer of security.

What Returns Do Property Bonds Average?

The returns on property bonds can vary depending on factors such as the creditworthiness of the issuer, the quality and location of the underlying properties, and the overall state of the real estate market. Historically, property bond rates have offered attractive yields compared to traditional fixed-income investments, often ranging between 5% and 8% annually.

“Property bonds can provide investors with a unique opportunity to diversify their portfolios and potentially generate higher returns,” said Rachel Buscall, CEO of New Capital Link. “They offer a hedge against inflation while allowing investors to participate in the growth of the real estate market indirectly.”

Rachel Buscall, CEO of New Capital Link.

How Are Property Bond Rates Determined?

Property bond rates are influenced by a variety of factors, including the prevailing interest rates in the broader market, the perceived risk associated with the underlying properties, and the supply and demand dynamics within the real estate sector. Issuers typically set the initial property bond rates based on these factors, aiming to offer competitive yields that attract investor interest.

Do the FCA Set Property Bond Rates?

No, the Financial Conduct Authority (FCA) does not directly set property bond rates. However, as the regulatory body overseeing the financial services industry in the UK, the FCA plays a crucial role in ensuring transparency, fair pricing, and investor protection within the property bond market.

How Often Do Property Bond Rates Change?

Property bond rates are not static and can change over time, reflecting market conditions and the performance of the underlying real estate assets. Issuers may adjust the rates periodically, either to align with market trends or in response to changes in the creditworthiness of the issuer or the quality of the collateral.

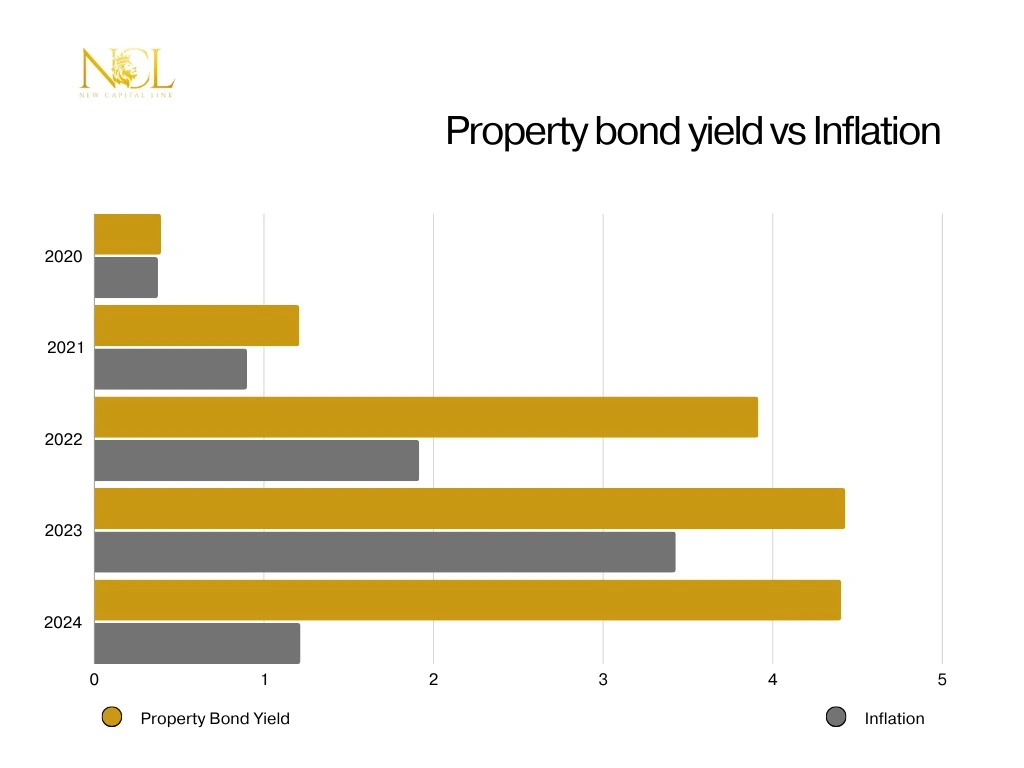

Do Property Bond Rates Move with Inflation?

Yes, property bond rates tend to move with inflation, as real estate values and rental income are generally influenced by inflationary pressures. When inflation rises, property bond rates may also increase to compensate investors for the erosion of purchasing power and maintain attractive real returns.

Are Property Bonds Safe

Like any investment, property bonds carry inherent risks. However, they are generally considered safer than investing directly in real estate due to the diversification provided by the underlying portfolio of properties. Additionally, the collateralised nature of property bonds offers investors greater security compared to unsecured debt instruments.

Property Bond Specialist

New Capital Link is an alternative investment introducer that specialises in identifying companies of value that are raising capital. By introducing their client base to these promising opportunities, including property bonds, New Capital Link aims to provide investors with access to attractive investment opportunities while supporting the growth of innovative businesses.

With their extensive expertise and deep understanding of the property bond market, New Capital Link is well-positioned to guide investors through the intricacies of this asset class, helping them navigate the complexities and make informed investment decisions.

Overall, property bond rates offer investors a unique opportunity to participate in the real estate market while potentially generating higher returns and diversifying their portfolios. As with any investment, it is crucial to conduct thorough research, understand the risks involved, and seek professional advice to align with individual investment objectives and risk tolerance.