In today’s investment landscape, investors search for options beyond traditional stocks and bonds. New Capital Link has emerged as a key player in the alternative investment sector. This UK-based boutique firm connects qualified investors with exclusive opportunities that offer competitive returns.

But how can investors separate reliable firms from questionable ones? This article examines New Capital Link’s credentials, services, and safeguards to help investors make informed decisions.

What Exactly is New Capital Link?

New Capital Link specialises in introducing high-net-worth and sophisticated investors to alternative investment opportunities. The company doesn’t handle client funds directly – instead, they act as professional introducers who connect investors with carefully vetted investment providers.

Founded with a clear mission to provide professional investment solutions for high-net-worth individuals, New Capital Link has built an extensive client and provider network. They identified a market gap for professional advocates who could introduce wealthy investors to high-calibre investment companies.

Their approach rejects the ‘one size fits all’ model. They first identify each investor’s unique requirements before suggesting potential opportunities.

The Trust Factor: How Legitimate is New Capital Link?

When researching investment firms, potential investors often search terms like “New Capital Link scam” or “New Capital Link fraud” – a standard practice for anyone conducting due diligence. These searches show caution rather than genuine concerns about the company.

Several factors confirm New Capital Link’s legitimacy:

- Award-Winning Status: New Capital Link has won multiple industry awards, including “Best Alternative Investment Introducer” for two consecutive years.

- Transparent Operations: They maintain clear communication about their role as introducers rather than fund managers.

- Established Track Record: The company has a history of successful client introductions and positive investment outcomes, with average portfolio returns reaching 13.88%.

- Client Testimonials: Real client experiences, such as the documented case of Kris Aves, demonstrate the company’s commitment to ethical practices.

FCA Considerations and Investment Security

Investors often search “New Capital Link FCA” to check regulatory status. It’s important to understand that as introducers, New Capital Link operates differently from direct investment managers.

The investments they introduce clients to often include security features like:

- Legal charges on underlying property and land

- Independent Security Trustees for additional protection

- Asset-backed securities that provide tangible protection

In the property bond sector, many options they introduce are regulated by the Financial Conduct Authority (FCA), providing additional investor safeguards.

How New Capital Link Handles Complaints and Concerns

Every reputable financial firm must have clear procedures for addressing client concerns. New Capital Link values transparency in their client relationships, with established channels for handling any issues that arise.

The company’s client-focused approach includes:

- Direct access to investment providers

- Clear documentation of terms

- Regular communication about investment performance

- Responsive customer service

This commitment to client satisfaction has helped them maintain their reputation in the highly competitive alternative investment sector.

Investment Opportunities Through New Capital Link

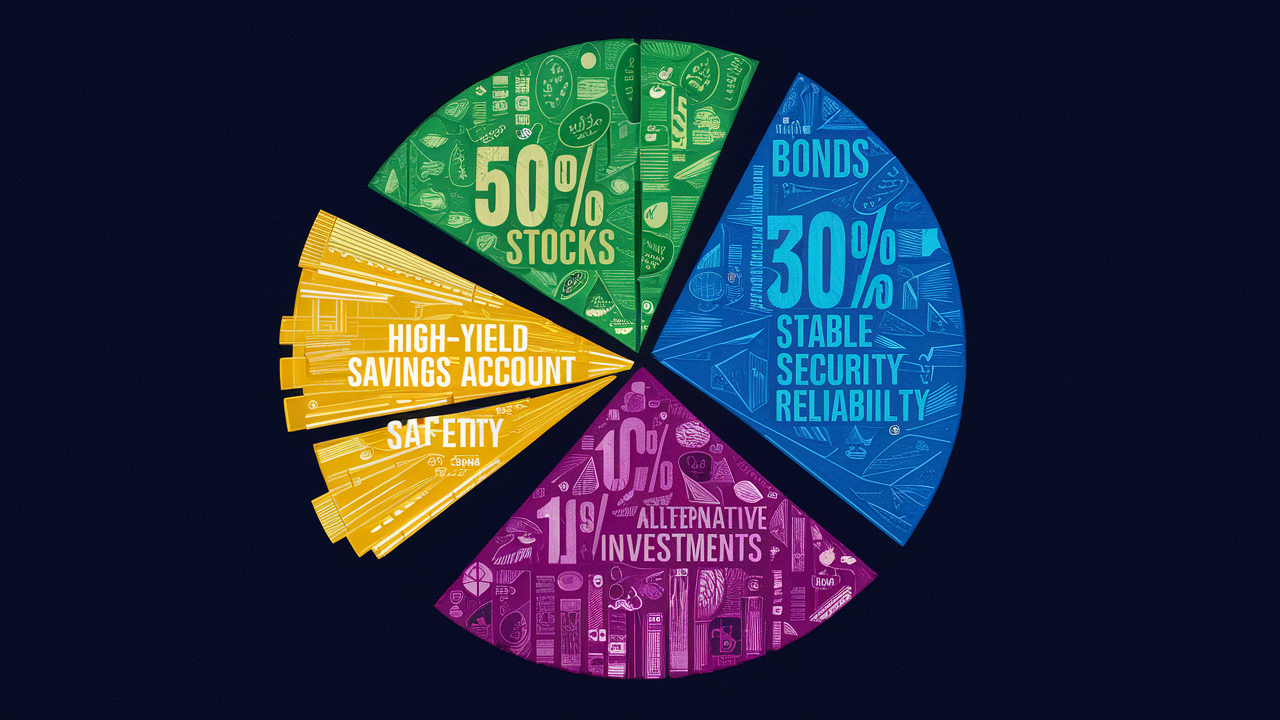

New Capital Link offers access to various alternative investments, including:

Property Bonds

These investments allow developers to secure funding from investors through loans. Property bonds typically offer fixed annual returns between 4% and 8%, with minimum investments ranging from £1,000 to £10,000. Terms usually last 2-5 years, with interest paid monthly, quarterly, annually, or at maturity.

Green Investments

New Capital Link opens doors to investments in climate technology, infrastructure, and innovations focused on fighting climate change. These opportunities align with growing investor interest in environmentally responsible options.

Private Equity and IPOs

They provide access to investments in private companies across various growth stages, offering potential for substantial long-term gains.

S/EIS Opportunities

The Seed Enterprise Investment Scheme (SEIS) and Enterprise Investment Scheme (EIS) are UK government-backed programs that encourage investment in early-stage companies while offering significant tax relief to investors.

The Leadership Behind New Capital Link

Under the leadership of CEO Rachel Buscall, New Capital Link has established itself as a trusted name in alternative investments. Buscall’s background in finance and property development formed the foundation for the company’s approach.

Before founding New Capital Link, Buscall gained experience raising capital for prominent UK property companies, contributing to award-winning developments across the country. Her four years in Dubai helped build relationships with high-net-worth individuals and private family offices, including connections with leading UAE gold providers.

This global network and financial expertise have helped shape New Capital Link’s premium alternative investment offerings.

Is New Capital Link Right for Your Investment Goals?

Alternative investments can generate significant returns, but they also carry risks. New Capital Link aims to find opportunities that balance potential returns with appropriate security measures.

Ideal clients for New Capital Link include:

- High-net-worth individuals seeking portfolio diversification

- Sophisticated investors looking for options beyond traditional markets

- Investors interested in asset-backed security

- Those seeking potentially higher returns than traditional savings products

As with any investment decision, potential clients should conduct their own research and consider seeking independent financial advice before proceeding.

Conclusion: The New Capital Link Difference

New Capital Link has built its reputation by focusing on three core principles: providing highly competitive returns, offering direct access to exclusive deals, and maintaining award-winning service standards.

Their commitment to introducing only carefully vetted opportunities has helped many investors access alternative options that might otherwise remain inaccessible. Through thorough due diligence and a focus on clients’ unique requirements, they continue to play an important role in the UK’s alternative investment landscape.

For qualified investors seeking alternative options beyond traditional markets, New Capital Link provides a gateway to opportunities that balance return potential with appropriate security measures.