In today’s fast-paced world, many people are looking for ways to increase their income without dedicating more time to traditional employment. This is where passive income comes into play. In this article, we’ll explore what passive income is, how it differs from active income, and the best ways to generate passive income in the UK, including alternative investments.

What is Passive Income?

Passive income refers to earnings derived from ventures in which an individual is not actively involved. In other words, it’s money earned with minimal ongoing effort or time commitment. The idea is to create or invest in income-generating assets that continue to produce revenue over time, even when you’re not actively working on them.

Examples of passive income include:

- Rental income from property investments

- Dividends from stocks

- Interest from savings accounts or bonds

- Royalties from intellectual property (books, music, patents)

- Earnings from online businesses or content creation

What is Active Income?

To better understand passive income, it’s helpful to contrast it with active income. Active income is money earned in exchange for performing a service or task. It’s the most common form of income for most people and typically includes:

- Salary from employment

- Wages from hourly work

- Commissions from sales

- Fees charged for professional services

The key difference is that active income requires your direct and ongoing involvement to generate earnings, while passive income continues to flow even when you’re not actively working.

Benefits of Passive Income

Generating passive income offers numerous advantages:

- Financial Security: Passive income provides an additional revenue stream, reducing reliance on a single source of income.

- Time Freedom: Once established, passive income allows you to earn money without trading your time for it directly.

- Scalability: Many passive income streams can be scaled up without a proportional increase in time or effort.

- Flexibility: Passive income can be generated from anywhere, offering location independence.

- Wealth Building: Reinvesting passive income can accelerate wealth accumulation over time.

- Early Retirement: Sufficient passive income can enable early retirement or financial independence.

What Investments are Passive Income?

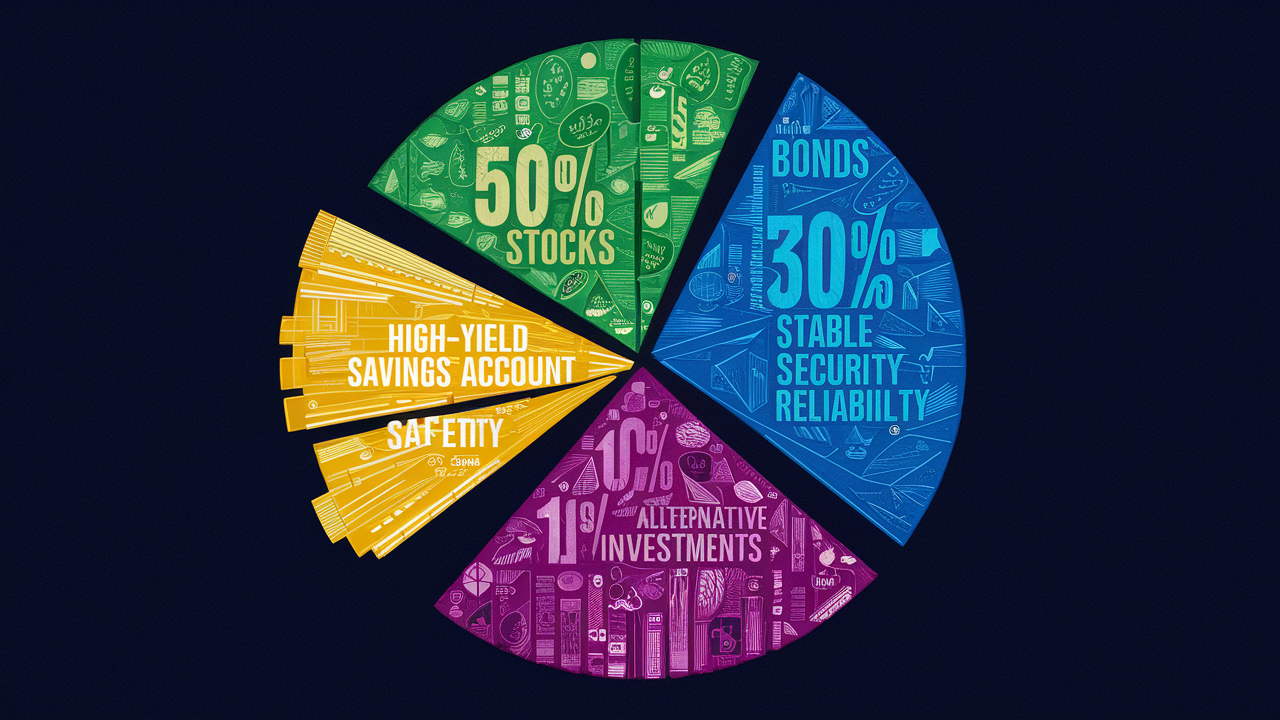

Several investment types can generate passive income:

- Real Estate: Rental properties, Real Estate Investment Trusts (REITs), or property crowdfunding platforms.

- Dividend-Paying Stocks: Shares in companies that regularly distribute a portion of their profits to shareholders.

- Bonds: Government or corporate bonds that pay regular interest.

- Peer-to-Peer Lending: Platforms where you can lend money to individuals or businesses for interest.

- Index Funds and ETFs: Diversified investment vehicles that can provide regular dividends and capital appreciation.

- Cryptocurrency Staking: Earning rewards by holding and “staking” certain cryptocurrencies.

- Royalty-Generating Assets: Investments in music rights, patents, or other intellectual property.

Best Ways to Make Passive Income

While there are many strategies to generate passive income in the UK, here are some of the most accessible and potentially lucrative options:

- Buy-to-Let Property: Investing in residential or commercial properties to rent out can provide a steady stream of passive income.

- Dividend Investing: Building a portfolio of dividend-paying stocks can offer regular income and potential capital appreciation.

- Create and Sell Online Courses: Leverage your expertise by creating and selling online courses on platforms like Udemy or Teachable.

- Start a Blog or YouTube Channel: While it requires initial effort, a successful blog or YouTube channel can generate passive income through advertising, sponsorships, and affiliate marketing.

- Write and Publish an E-book: Self-publishing platforms like Amazon Kindle Direct Publishing make it easy to write and sell e-books.

- Invest in Peer-to-Peer Lending: Platforms like Zopa or RateSetter allow you to lend money to individuals or businesses for interest.

- Create a Mobile App: Developing a successful app can generate ongoing revenue through purchases, subscriptions, or advertising.

- Rent Out Your Parking Space: If you have an unused parking space in a high-demand area, you can rent it out using apps like JustPark.

Alternative Investments London

London, as a global financial hub, offers unique opportunities for alternative investments that can generate passive income:

- Fine Art and Collectibles: Investing in art, rare coins, or other collectibles can provide both appreciation and potential rental income to museums or exhibitions.

- Private Equity: London is home to numerous private equity firms that offer investment opportunities in growing businesses.

- Hedge Funds: While typically requiring significant capital, hedge funds can provide diversified investment strategies and potentially higher returns.

- Infrastructure Projects: London often has opportunities to invest in large-scale infrastructure projects that can generate long-term, stable returns.

- Green Energy Projects: With the UK’s focus on renewable energy, investing in solar or wind projects can provide both environmental benefits and passive income.

- Luxury Property Fractional Ownership: Platforms like CapitalRise offer opportunities to invest in high-end London properties without the need to purchase entire buildings.

- Fintech and Startup Investments: London’s thriving tech scene provides opportunities to invest in innovative startups through equity crowdfunding platforms.

About New Capital Link

New Capital Link is a leading alternative investment introducer based in London. We specialize in connecting investors with unique and potentially lucrative investment opportunities that fall outside traditional asset classes. Our team of experienced professionals carefully vets each investment opportunity, focusing on those with the potential to generate significant passive income for our clients.

At New Capital Link, we understand that every investor’s needs and risk tolerance are different. We work closely with our clients to understand their financial goals and match them with appropriate alternative investment opportunities. Whether you’re interested in real estate, private equity, hedge funds, or emerging technologies, New Capital Link can help you diversify your portfolio and potentially increase your passive income streams.

Our commitment to due diligence, transparency, and personalized service has made us a trusted partner for investors seeking to explore the world of alternative investments. Contact New Capital Link today to learn more about how we can help you build your passive income strategy through alternative investments in London and beyond.