A comprehensive guide from New Capital Link

Having £40,000 to invest puts you in an advantageous position to build substantial wealth and secure your financial future. However, with traditional savings accounts offering minimal returns and market volatility creating uncertainty, sophisticated investors are increasingly turning to alternative investments to diversify their portfolios and achieve meaningful growth.

At New Capital Link, we’ve guided countless investors through the process of deploying capital effectively. Our motto, “Not Promised, Proven,” reflects our commitment to delivering real results rather than empty promises. Here’s your comprehensive guide to investing £40,000 strategically.

Understanding Your Investment Foundation

Before exploring specific opportunities, successful investing requires a solid foundation. With £40,000, you have sufficient capital to access investment opportunities typically reserved for high-net-worth individuals, but strategic planning remains essential.

Key Considerations:

- Risk tolerance: Understanding your comfort level with potential losses

- Investment timeline: Whether you’re investing for 5, 10, or 20+ years

- Income requirements: If you need regular returns or can focus on capital growth

- Diversification goals: Spreading risk across different asset classes

The Alternative Investment Advantage

Traditional investments like stocks and bonds have their place, but alternative investments offer unique advantages that can enhance your portfolio’s performance and resilience.

Why Consider Alternatives?

Portfolio Diversification: Alternative investments often have low correlation with traditional markets, providing protection during economic downturns.

Inflation Protection: Many alternatives, particularly tangible assets, tend to maintain or increase value during inflationary periods.

Higher Return Potential: Certain alternative investments can offer superior returns compared to traditional assets, though with commensurate risk.

Access to Exclusive Opportunities: With £40,000, you can access investment opportunities not available to smaller investors.

Strategic Investment Categories for £40,000

Property-Based Investments (25-40% allocation)

Property remains one of the most reliable long-term wealth builders, and with £40,000, you have several sophisticated options:

Property Development Bonds: These offer exposure to development projects without the complexities of direct property ownership. Typical returns range from 6-12% annually, with capital protection features.

ISA-Eligible Property Bonds: These provide tax-efficient growth while maintaining liquidity. New Capital Link’s ISA-eligible property bonds allow you to maximize your annual ISA allowance while accessing institutional-grade property investments.

Off-Plan Opportunities: Investing in properties before completion can offer significant capital appreciation potential, particularly in high-growth areas.

Green Energy and ESG Investments (15-25% allocation)

The transition to renewable energy presents compelling investment opportunities with both financial and environmental benefits:

Solar and Wind Projects: Direct investment in renewable energy infrastructure offers stable, long-term returns typically ranging from 5-8% annually.

Battery Storage Projects: With the UK government investing heavily in energy storage, these projects offer exposure to critical infrastructure development.

Green Bonds: These provide lower-risk exposure to environmentally sustainable projects while offering competitive returns.

Technology and Innovation (10-20% allocation)

The digital transformation continues to create exceptional investment opportunities:

AI and Computing Infrastructure: Through partnerships with companies like NextGen Cloud (a preferred Nvidia partner), investors can access the growing artificial intelligence sector.

AgriTech Solutions: Vertical farming and agricultural innovation present opportunities in food security and sustainable farming practices.

FinTech Developments: The evolution of financial services creates opportunities in payment processing, digital banking, and blockchain technologies.

Commodities and Precious Metals (10-15% allocation)

Physical assets provide portfolio stability and inflation protection:

Precious Metals: Gold and silver offer traditional safe-haven characteristics, particularly valuable during economic uncertainty.

Industrial Commodities: Copper, lithium, and other critical materials benefit from infrastructure development and green energy transition.

Agricultural Products: Food commodities provide exposure to global population growth and changing dietary preferences.

Alternative Lending (5-15% allocation)

Direct lending to businesses and individuals can provide attractive yields:

Bridging Finance: Short-term lending for property transactions typically offers 8-12% returns with asset-backed security.

Development Finance: Funding construction projects provides higher returns with professional risk management.

Peer-to-Business Lending: Supporting SMEs through direct lending platforms with diversified risk exposure.

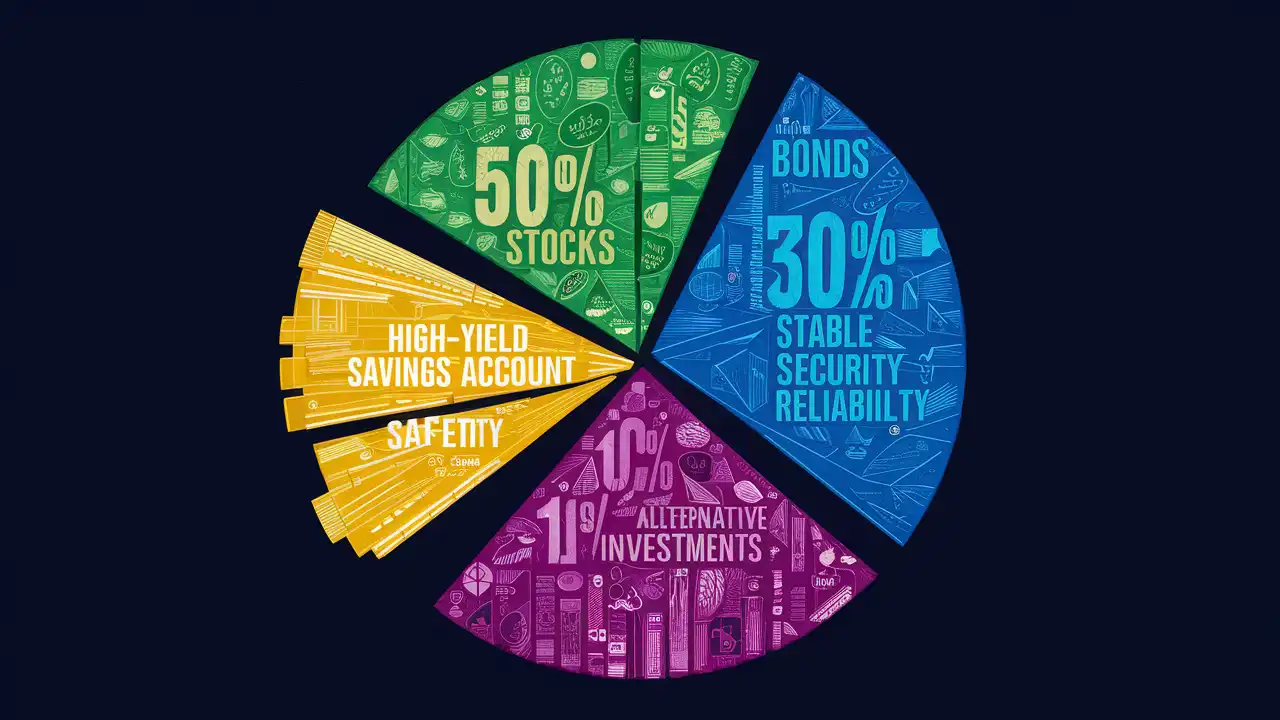

Portfolio Construction Strategy

For a £40,000 investment, consider this strategic allocation:

Conservative Approach (Lower Risk):

- 40% Property-based investments

- 25% Green energy projects

- 15% Precious metals and commodities

- 10% Alternative lending

- 10% Cash/liquid alternatives

Balanced Approach (Moderate Risk):

- 35% Property-based investments

- 20% Green energy projects

- 20% Technology and innovation

- 15% Commodities

- 10% Alternative lending

Growth-Focused Approach (Higher Risk):

- 30% Technology and innovation

- 25% Property development

- 20% Green energy

- 15% Alternative lending

- 10% Commodities

Risk Management and Due Diligence

With £40,000 representing a significant investment, proper risk management becomes crucial:

Diversification: Never invest more than 20% of your capital in a single opportunity, regardless of how attractive it appears.

Professional Vetting: Work with established introducers who conduct thorough due diligence on investment opportunities.

Regulatory Compliance: Ensure all investments comply with FCA regulations and offer appropriate investor protections.

Documentation Review: Carefully examine all investment documentation, including risk factors and exit strategies.

Tax Optimization Strategies

Maximizing after-tax returns significantly impacts your long-term wealth building:

ISA Utilization: Use your £20,000 annual ISA allowance for tax-free growth on suitable investments.

SIPP Contributions: Consider pension contributions for tax relief while accessing alternative investments through Self-Invested Personal Pensions.

Capital Gains Planning: Structure investments to optimize capital gains tax treatment, particularly for longer-term holdings.

Income vs. Growth: Balance income-producing assets with capital growth investments based on your tax situation.

Monitoring and Rebalancing

Successful investing requires ongoing attention and periodic adjustments:

Regular Reviews: Assess portfolio performance quarterly and rebalance annually or when allocations drift significantly from targets.

Market Adaptation: Stay informed about changing market conditions and adjust strategies accordingly.

Opportunity Assessment: Continuously evaluate new investment opportunities that align with your strategy and risk tolerance.

Professional Guidance: Maintain relationships with investment professionals who can provide ongoing advice and access to exclusive opportunities.

Common Pitfalls to Avoid

Learning from others’ mistakes can save significant capital:

Over-Concentration: Avoiding the temptation to put too much capital into a single “sure thing” investment.

Emotional Decision-Making: Making investment decisions based on fear or greed rather than strategic analysis.

Inadequate Due Diligence: Failing to properly research investments or relying solely on promotional materials.

Liquidity Neglect: Not maintaining sufficient liquid assets for emergencies or opportunities.

Tax Inefficiency: Ignoring tax implications when structuring investments.

Building for the Future

With £40,000 properly invested, you’re establishing the foundation for substantial long-term wealth. The key lies in:

Consistent Strategy: Sticking to your planned approach rather than chasing market trends.

Compound Growth: Reinvesting returns to accelerate wealth building over time.

Knowledge Development: Continuously educating yourself about investment opportunities and market developments.

Professional Networks: Building relationships with investment professionals, advisors, and other successful investors.

Long-Term Perspective: Focusing on long-term wealth building rather than short-term gains.

Getting Started

Investing £40,000 effectively requires careful planning and professional guidance. At New Capital Link, we specialize in connecting sophisticated investors with carefully vetted alternative investment opportunities that traditional financial institutions often cannot access.

Our award-winning team, led by CEO Rachel Buscall, has established relationships with leading investment providers across multiple sectors. Whether you’re interested in property development, green energy projects, technology innovations, or diversified alternative strategies, we provide the expertise and access needed to deploy your capital effectively.

Remember, successful investing is not about timing the market perfectly or finding the single best opportunity. It’s about building a diversified portfolio of quality investments that align with your goals, risk tolerance, and timeline. With £40,000 and the right strategy, you’re well-positioned to build substantial wealth and achieve your financial objectives.

This article is for informational purposes only and should not be considered personal financial advice. All investments carry risk, and past performance does not guarantee future results. Please consult with qualified financial professionals before making investment decisions.

About New Capital Link: New Capital Link is a London-based boutique alternative investment firm specializing in introducing high-net-worth and sophisticated investors to exclusive investment opportunities worldwide. With multiple industry awards and a proven track record, we provide access to carefully vetted alternatives across property, green energy, technology, and other sectors