In the rapidly evolving landscape of financial services, Independent Financial Advisors (IFAs) are increasingly exploring alternative investment strategies to deliver superior value to their clients. The traditional investment paradigms are shifting, and sophisticated investors are seeking more dynamic and potentially lucrative opportunities beyond conventional stock and bond portfolios.

What is an Alternative Investment?

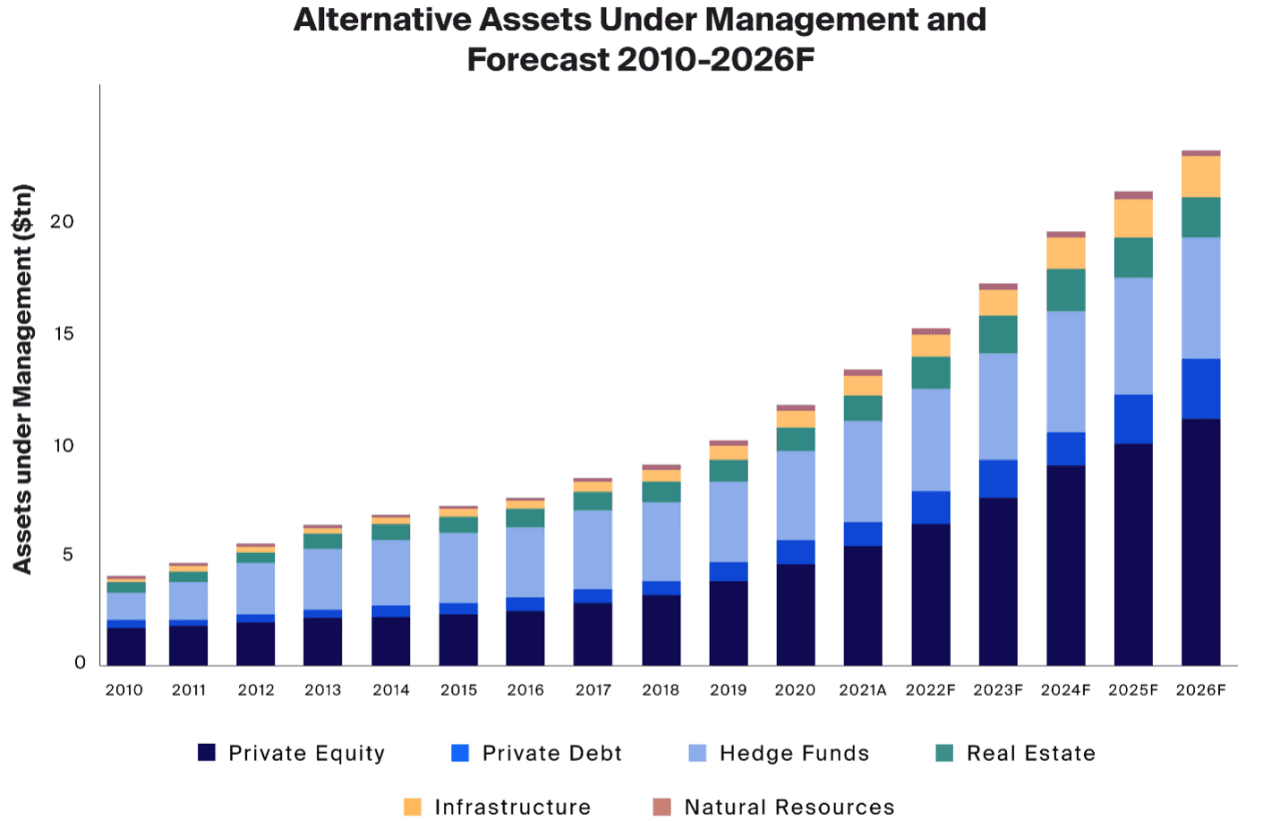

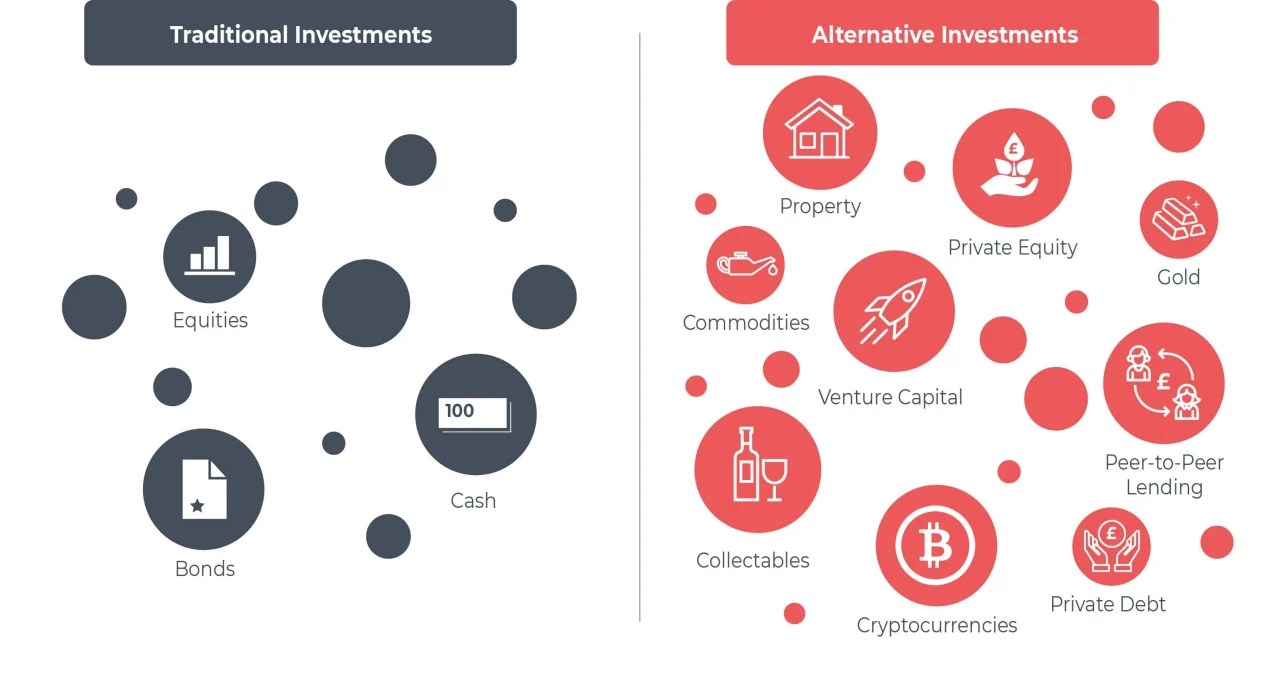

Alternative investments represent a diverse range of financial assets that fall outside traditional investment categories like stocks, bonds, and cash. These investments encompass a wide spectrum of opportunities, including private equity, social housing developments, green technology investments, commodities, hedge funds, real estate, and innovative sector-specific ventures. Unlike mainstream financial instruments, alternative investments often provide unique value propositions with potentially higher returns and strategic diversification benefits.

Do Financial Advisors Issue Alternative Investments?

Historically, financial advisors were hesitant to recommend alternative investments. However, this approach has witnessed a monumental transformation in the past three years. Today, regulated financial professionals increasingly allocate between 10% and 30% of client portfolios to alternative investment strategies. This shift reflects a growing recognition of the nuanced benefits these investments can offer sophisticated investors seeking enhanced portfolio performance.

Why Would Wealth Managers Offer Alternative Investments?

Wealth managers are embracing alternative investments for two primary reasons. Firstly, they can provide clients with potentially higher rewards while maintaining a balanced risk profile. Secondly, these investment vehicles often present more attractive commission structures for financial advisors, creating a mutually beneficial ecosystem of economic innovation and opportunity.

Examples of Alternative Investments

Social Housing Investments

Alderley Group exemplifies a pioneering approach to alternative investments through social housing developments. By collaborating with government entities like Homes England, they offer socially responsible investments that simultaneously generate financial returns and address critical housing infrastructure needs.

Private Equity in Emerging Technologies

Nextgen represents an exciting opportunity in the artificial intelligence sector. It is positioned as a preferred partner for industry leaders like NVIDIA. Its investment model provides exposure to cutting-edge technological developments with significant upside potential.

Green and Ethical Investments

Intergroup Mining and Innovation Agritech showcase the potential of sustainable investment strategies. Through mining and vertical farming innovations, they demonstrate how alternative investments can align financial objectives with environmental and social responsibility.

What Kind of Returns Are Typical for Alternative Investments?

Alternative investments are characterised by the potential for above-average returns and carefully managed risk profiles. While traditional investments might offer modest single-digit returns, alternative investments can generate returns ranging from 8% to 15% or even higher, depending on the specific sector and investment strategy.

How Can IFAs Offer Alternative Investments?

Financial advisors can expand their investment offerings by partnering with specialised platforms like New Capital Link. These networks provide access to meticulously curated alternative investment opportunities, enabling IFAs to diversify their client portfolios effectively.

“At New Capital Link, we’re committed to revolutionising investment strategies by connecting sophisticated investors with innovative alternative investment opportunities,” says Rachel Buscall, CEO of New Capital Link. “Our mission is to empower financial advisors with cutting-edge investment solutions that deliver exceptional value.”

Key Considerations for IFAs in Alternative Investments

Regulatory Landscape

The Financial Conduct Authority (FCA) maintains strict oversight of alternative investment promotions, particularly focusing on unregulated collective investment schemes (UCIS). IFAs must prioritise regulated funds and ensure comprehensive risk disclosure.

Risk and Liquidity

Successful alternative investment strategies demand careful evaluation of liquidity, clear exit strategies, and a thorough understanding of potential risks. IFAs must conduct rigorous due diligence on fund management teams and historical performance.

Alternative Investments London

New Capital Link stands at the forefront of alternative investment innovation in London. With a dedicated team of experts and a robust network of investment opportunities, they provide IFAs and wealth managers with access to sophisticated, regulated investment strategies.

Contact New Capital Link

Interested financial advisors can contact New Capital Link today for a complimentary consultation. Whether you prefer face-to-face meetings or remote discussions, their team is ready to explore how alternative investments can transform your client offerings.

Disclaimer: Alternative investments carry inherent risks and may not be suitable for all investors. Always consult with qualified financial professionals and conduct thorough research before making investment decisions.

Related pages: